Year

Average

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

1999-2013

Average monthly portfolios return (%)

SV

7.90

0.88

10.93

8.14

6.64

-0.40

0.59

2.00

0.55

−2.15

7.63

4.05

1.18

5.22

0.15

3.56

SN

6.65

3.84

3.33

6.06

4.33

−0.54

0.93

2.03

1.15

−4.21

7.48

2.53

0.01

6.89

2.72

2.88

SG

5.46

1.83

9.20

2.46

11.31

3.92

−0.02

−1.72

0.02

−4.01

3.97

2.17

7.75

8.57

−0.18

3.38

Standard Deviation of portfolios  (%)

(%)

SV

20.94

6.33

16.49

7.60

9.24

2.78

3.82

5.37

2.55

9.57

8.08

10.47

6.56

5.57

9.70

8.34

SN

20.49

6.06

12.08

6.48

5.80

3.51

2.70

3.88

3.61

13.20

5.77

6.72

6.31

6.53

7.76

7.39

SG

20.55

9.54

16.75

8.99

16.51

9.17

2.82

6.18

3.26

12.14

6.56

4.65

11.53

5.29

8.09

9.47

Sharpe Ratio:

SV

0.35

0.06

0.63

1.02

0.69

−0.29

0.04

0.29

0.07

−0.26

0.90

0.36

0.13

0.88

−0.02

0.32

SN

0.29

0.55

0.24

0.88

0.69

−0.27

0.19

0.41

0.21

−0.35

1.24

0.33

−0.05

1.01

0.31

0.38

SG

0.23

0.14

0.52

0.23

0.67

0.38

−0.16

−0.35

−0.11

−0.36

0.55

0.40

0.65

1.56

−0.06

0.29

Difference in S.D  (%)

(%)

SV−SG

0.39

−3.21

−0.27

−1.39

−7.26

−6.39

1.00

−0.81

−0.72

−2.57

1.53

5.83

−4.97

0.29

1.61

−1.13

Difference in returns (WMGS) (%)

−

−

2.51

−0.95

1.73

5.69

−4.67

−4.32

0.60

3.71

0.53

1.86

3.65

1.89

−6.57

−3.35

0.33

0.18

(0.283)

(−0.319)

(0.247)

(1.547)*

(−0.849)

(−0.76)

(0.426)

(1.555)*

(0.435)

(0.42)

(1.2)

(0.558)

(−1.673)*

(−1.21)

(0.093)

(0.149)

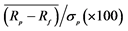

Difference in Sharpe ratio (×100)

SV − SG

0.12

−0.08

0.11

0.79

0.02

−0.67

0.20

0.64

0.18

0.10

0.35

−0.04

−0.51

−0.68

0.04

0.037

(0.27)

(−0.205)

(0.269)

(1.788)**

(0.044)

(−0.991)

(0.471)

(1.541)*

(0.426)

(0.239)

(0.84)

(−0.108)

(−1.228)

(−1.332)*

(0.113)

(0.309)